What is Intraday Margin?

Discover how using borrowed capital can unlock bigger opportunities, amplify returns, and keep risks in check.

Many new traders wonder how it is possible to handle large stock positions with only a small amount of capital. This is where intraday margin comes into play.

Imagine a trader who has only ₹10,000 but is able to take a position worth ₹50,000 using the margin facility offered by a broker. If the trade turns favorable, profits can multiply, but so can the risks. Such leverage can be exciting but also dangerous when used without discipline.

In this article, we will explain what intraday margin is and what every trader needs to know before using it.

Margin in intraday trading

In intraday margin trading, the broker lends you part of the capital needed to open a trading position, so you need to pay only a fraction (margin) of the full value.

All positions must be closed before market close, so the borrowed funds are settled by the end of the day.

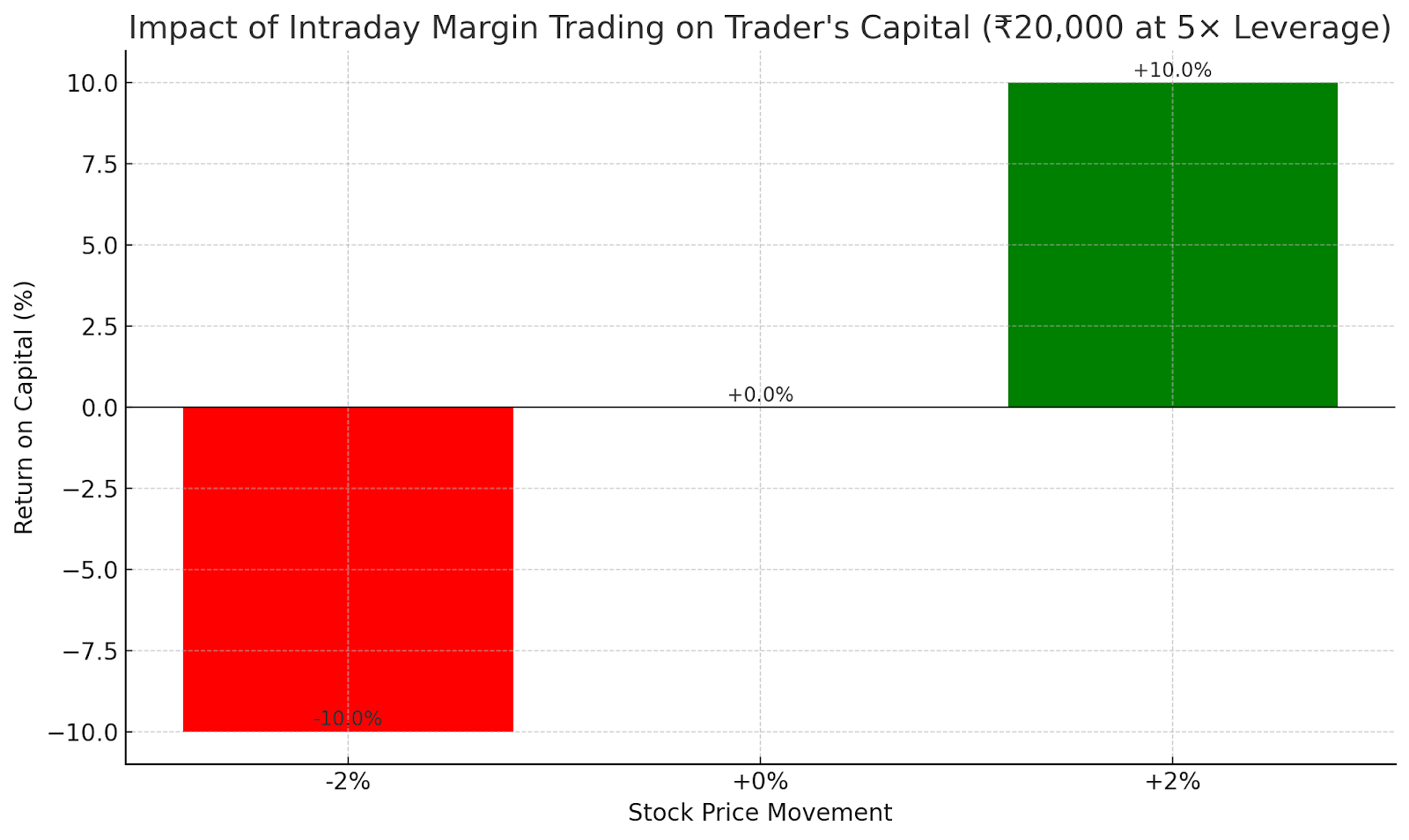

Suppose you have ₹20,000 in your trading account, and your broker offers 5x leverage for intraday trading. This means you can buy shares worth ₹1,00,000 by using only ₹20,000 as margin.

Now, if the stock price rises by 2%, your total position becomes ₹1,02,000. After returning the borrowed ₹80,000, you’re left with a profit of ₹2,000. That’s a 10% return on your own capital. However, if the stock drops by 2%, your position falls to ₹98,000, leading to a ₹2,000 loss, which is also 10% of your capital.

Here's a graph that visually shows how a 2% stock move (up or down) leads to a 10% gain or loss when trading with 5× leverage.

Since borrowed money amplifies both gains and losses, the risks are equally magnified. To manage this, brokers often enforce auto-square-off if your margin balance falls below a required maintenance level.

All intraday positions are auto-squared off around 3:15 PM if not closed manually, in line with SEBI’s peak-margin norms.

SEBI’s rules for margin trading

To protect both market integrity and investor interests, SEBI has certain rules and limits around margin and leverage. Below is an overview of the key regulations as of now.

- SEBI requires that margin trading must be supported by formal pledging of securities, thereby preventing brokers from misusing client holdings.

- The circular mandates that margin obligations must be met by pledging or re-pledging securities through the depository system (i.e., via NSDL/CDSL) rather than off-system pledges (effective from September 2025).

- In new norms, brokers must collect 100 % of the peak margin during the trading day to prevent margin shortfalls.

- Brokers are required to disclose their exposure under the Margin Trading Facility (MTF) by 6:00 PM on the next business day.

- Cash collateral (money deposited by the client) can be used as part of the maintenance margin, provided the securities resulting from it are pledged to the broker.

- SEBI requires a minimum upfront margin in the cash equity segment (commonly 20 % of transaction value) for trades.

- Brokers are prohibited from offering excessive leverage beyond limits set under SEBI rules (e.g., intraday leverage restrictions).

- Securities to be used as margin must belong to specified eligible lists and must be pledged via the demat system (not by power of attorney).

- Daily reporting by trading members is required for client‐wise collateral status to enhance transparency and investor protection.

The advantages and risks

Use of intraday margin can amplify trading potential, but it brings a balance of opportunity and danger. Here are some key advantages and risks of using intraday margin:

What traders should know?

When using intraday margin, success relies less on taking aggressive positions and more on disciplined risk control. Below are key practices that every trader should internalize.

1. Define your risk per trade clearly

Decide in advance how much of your capital you are willing to lose on any single trade. Many traders adopt the “15 to 2% rule,” meaning you should risk no more than this percentage of your total trading capital on one position.

This ensures that your few bad trades cannot wipe out your entire capital.

2. Use stop-loss orders without fail

A stop loss order automatically closes your position when the price hits a predetermined level, limiting your downside.

Never enter a trade without attaching a stop loss. It removes emotions from the decision-making process.

3. Enforce a favorable risk-reward ratio

Before entering any trade, assess whether your potential reward justifies the risk. A common benchmark is a 1:3 ratio, meaning for every rupee you risk, aim to gain three.

Even if many trades go wrong, a few successful ones with a strong risk-reward profile can keep you profitable.

4. Control your position size

The size of your position matters. Even if your margin allows for a large exposure, size your trade so that a full stop loss hit does not severely impact your account.

Combining position sizing with stop limits builds a solid foundation for managing risk.

5. Avoid overleveraging

Use only modest leverage. Taking on too much borrowed capital raises your exposure, so a minor adverse move can quickly wipe out your account.

Always check margin levels, cap your leverage to what your risk tolerance allows, and never stretch your account beyond safety. Overleveraging is a fast path to forced liquidation.

To conclude

Intraday margin can unlock higher exposure, but only when matched with vigilance. Traders must obey broker and regulatory rules, use protective tools like stop losses, and keep position sizes in check. With careful judgment and consistent risk control, intraday leverage can aid growth and never become a source of ruin.