ITM vs ATM vs OTM Options explained for traders

Understand ITM, ATM, and OTM options in trading. Learn what moneyness means, how these options differ, and their impact on premiums, risk, and trading decisions.

Many traders begin exploring options without fully understanding one of its most important concepts: moneyness, which helps you gauge the actual worth of an option

Warren Buffett once said, “Risk comes from not knowing what you’re doing.” This quote is a practical reminder that learning these fundamentals is not just academic. It forms the base for making informed decisions in trading.

In this article, we’ll walk you through what option moneyness is and how each can impact your trading decisions.

What Is ‘Moneyness’ in Options?

Moneyness is a term used in options trading to describe the relationship between an option’s strike price and the current market price of the underlying asset. It helps determine whether exercising the option would result in a profit, a loss, or no financial gain.

This concept plays a critical role in how options are valued and how traders assess the potential of a given contract.

There are three main types of moneyness:

- In-the-Money (ITM)

- At-the-Money (ATM)

- Out-of-the-Money (OTM)

Each term describes the option’s value position relative to the current market price.

To make this clearer, imagine a stock that is currently trading at ₹500. If you have a call option with a strike price of ₹480, you can buy the stock for less than the market price. This means the option is considered in the money, as exercising it would give you an immediate profit.

If your option has a strike price of ₹500, which is equal to the current market price, it is said to be at-the-money, meaning there is no advantage or disadvantage in exercising it.

However, if your strike price is ₹520, the option is out-of-the-money, since you would be paying more than what the stock is actually worth in the market. Exercising it in this case would not be beneficial.

What are ITM Options?

In-the-Money (ITM) Options are contracts where the strike price is already favorable compared to the current market price.

For a call option, this means the strike price is lower than the asset’s current value. For a put option, it means the strike price is higher than the market price.

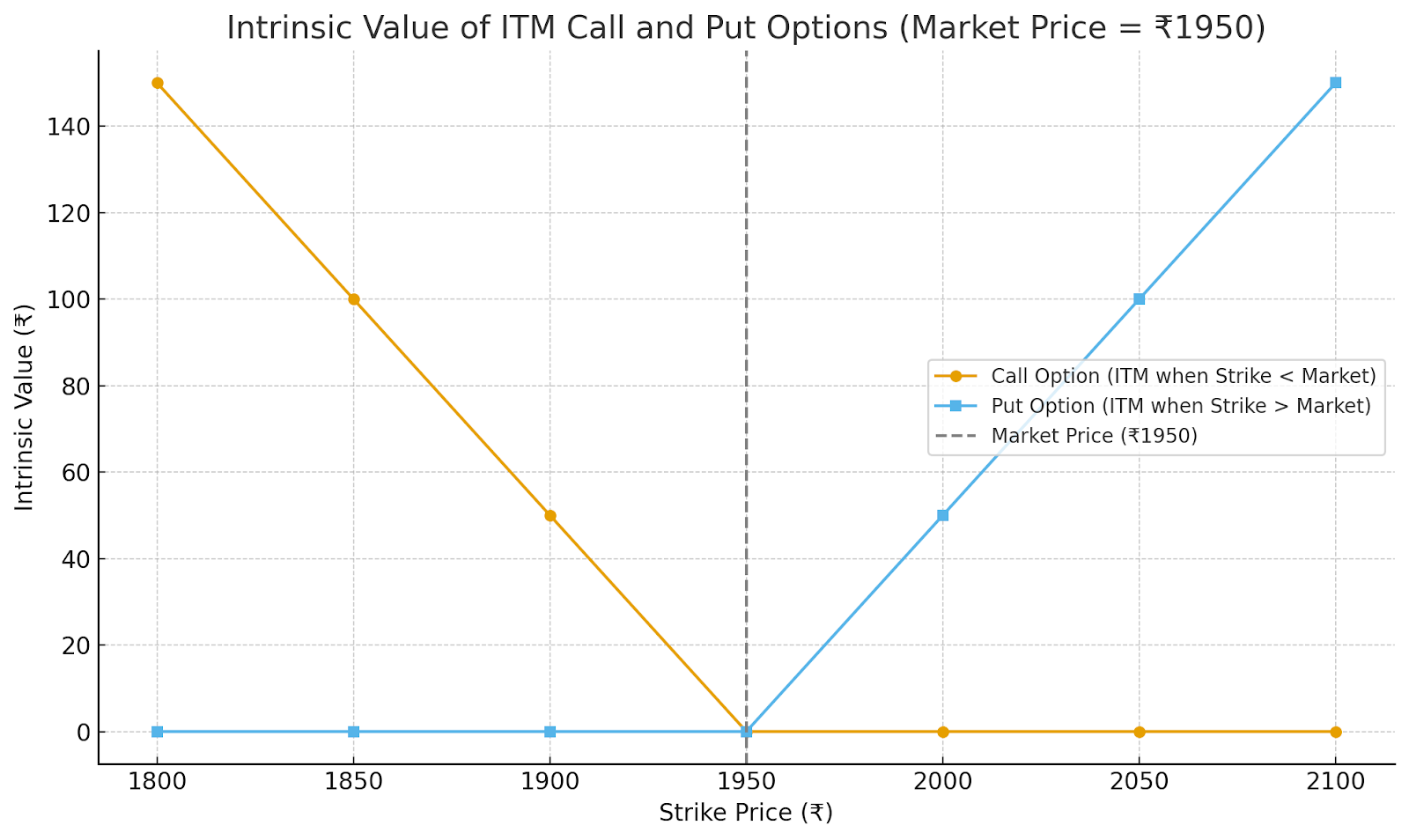

These options carry intrinsic value, making them more likely to be exercised profitably. For example, if a trader buys a call option on ABC Ltd. with a strike price of ₹1,800 while the stock is trading at ₹1,950, the option is ₹150 in the money. This built-in value gives traders a strategic edge.

Here is a simple graph that shows how the intrinsic value of call and put options changes with strike price, helping you visually understand when an option is considered in-the-money (ITM).

Although ITM options usually have higher premiums, many traders prefer them for their lower risk and higher probability of return compared to out-of-the-money alternatives.

What are ATM Options?

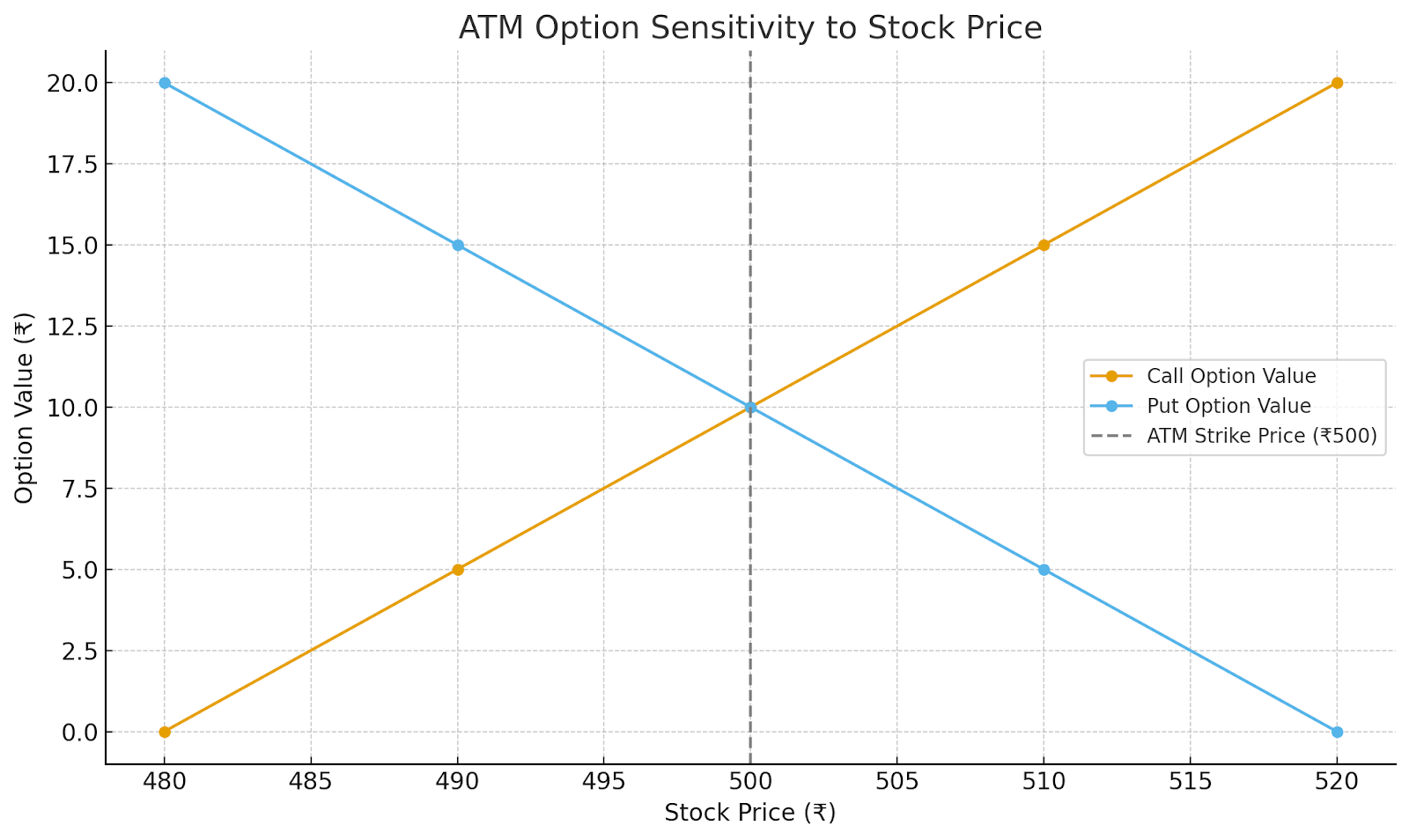

At-the-Money (ATM) Options are those where the option’s strike price is nearly equal to the current market price of the underlying asset.

These contracts don’t carry intrinsic value but hold maximum time value, making them highly responsive to price fluctuations. For instance, if a stock is trading at ₹500, both a ₹500 call and a ₹500 put option would be considered at-the-money.

To picture how at-the-money options react to price changes, the graph below illustrates how their value shifts with even minor movements in the underlying stock.

Traders often choose ATM options when they expect a sharp move in either direction, such as during earnings announcements.

Since even a slight shift can affect their value significantly, these options are ideal for short-term strategies that rely on volatility rather than directional certainty.

What are OTM Options?

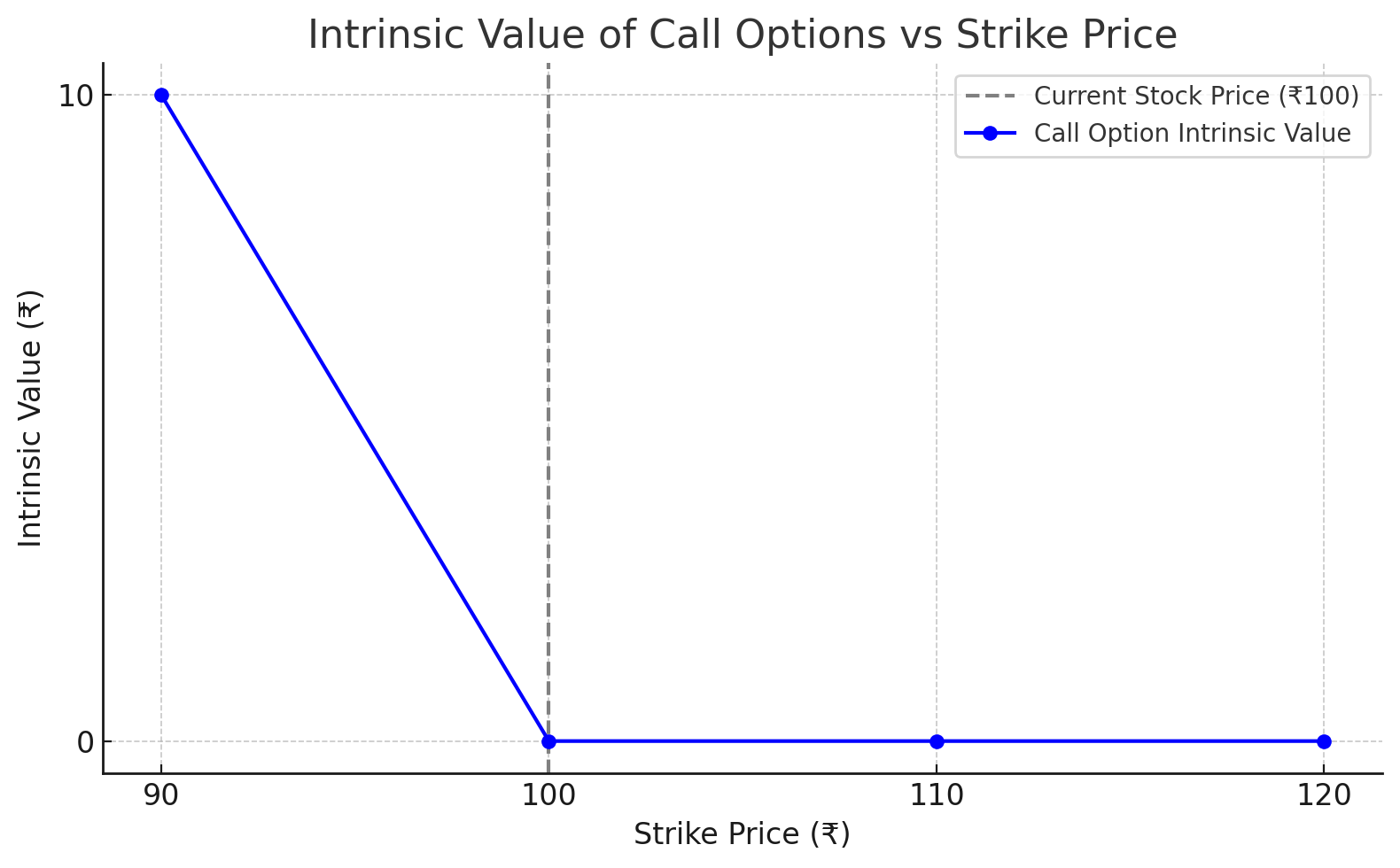

An option is considered Out-of-the-Money when it lacks intrinsic value. In the case of a call option, this happens when the strike price is higher than the current market price of the underlying asset. For example, if a stock is trading at ₹100, a call option with a strike price of ₹110 would be classified as OTM.

Below is a graph illustrating how call options with strike prices above ₹100 are Out-of-the-Money, offering zero intrinsic value at the current stock price.

Since the option has no immediate profit potential, it trades at a lower premium. Similarly, a put option is OTM when its strike price is below the market price.

These options offer higher potential returns but come with increased risk, as they will expire worthless unless the market moves significantly in the trader’s favor before the contract’s expiration.

Now that you have a clear understanding of what ITM, ATM, and OTM mean individually, let’s move one step further and see how they differ from each other in terms of value, risk, and practical use in trading.

ITM vs ATM vs OTM

Here is how ITM vs ATM vs OTM differ in core attributes for traders:

Note: Choosing between ITM, ATM, and OTM ultimately depends on your trading objective, risk tolerance, and how much premium you are willing to pay upfront.

Impact on premiums and risk

The pricing and risk profile of options, whether they are ITM, ATM, or OTM, play a key role in how traders choose their strategies.

One of the first things to consider is the premium, which refers to the amount a trader pays to enter an option contract. It is made up of two parts:

- Intrinsic value: The real, built-in value of the option.

- Time value: The portion of the premium attributed to the time left before expiration.

Here’s how premiums vary across ITM, ATM, and OTM options:

An ITM option costs more but offers a higher chance of being profitable. In contrast, OTM options are cheaper but require a significant move in the underlying asset just to break even.

Now, let's talk risk and return potential, both from the trader’s and the option seller’s perspective.

The risk and reward profile of an option depends on its moneyness.

- ITM options carry lower risk because they already have intrinsic value, but they are more expensive and offer limited upside compared to their cost.

- ATM options involve moderate risk and provide balanced reward potential, making them suitable for short-term or volatility-based strategies.

- OTM options are the most speculative, with the lowest cost but highest risk. They need a significant price move to become profitable and have a higher chance of expiring worthless, although they offer the highest percentage returns if the trade goes well.

To conclude

Many traders miss just how valuable it is to fully grasp ITM, ATM, and OTM options. Knowing the difference isn’t just about definitions; it guides your strategy across different markets. These terms, when understood well, help traders make clearer choices. They offer a solid base for evaluating trade setups while also helping manage possible losses and improve potential returns.