Gold price trends and Shubh Muhurat for Dhanteras 2025

In 2024, gold prices rose nearly 30% year-on-year during the Diwali season, to nearly ₹78,700 per 10 grams from ₹60,750 the previous year.

The price of gold has risen to an all-time high in 2025. As of 1st October 2025, 24K gold was trading above ₹1,20,000 per 10 grams in Indian markets. Jewellers anticipate a robust festive demand driven by strong festive sentiment despite these record levels.

Dhanteras, or Dhantrayodashi, marks the start of the Diwali celebrations in India. On Dhanteras, buying gold and silver is considered an invitation to Lord Dhanvantari and Goddess Lakshmi to enter the home. Because of its liquidity, cultural significance, and financial stability, gold is the most popular precious metal among gold, silver, and platinum.

Gold price movements on Dhanteras (2014–2024)

Over the last decade, gold prices have surged more than 3x, due to inflation, rupee depreciation, and global safe-haven flows.

In 2024, gold prices rose nearly 30% year-on-year during the Diwali season, to nearly ₹78,700 per 10 grams from ₹60,750 the previous year.

Shubh muhurat to buy Gold on Dhanteras 2025

According to the Hindu Panchang, the Trayodashi Tithi for Dhanteras in 2025 begins at 12:18 PM on October 18 and ends at 1:51 PM on October 19.

The evening hours of October 18 are considered most auspicious for purchasing gold. During this window, most jewellers will offer festive schemes and discounts, making it both a spiritually and financially rewarding time to buy.

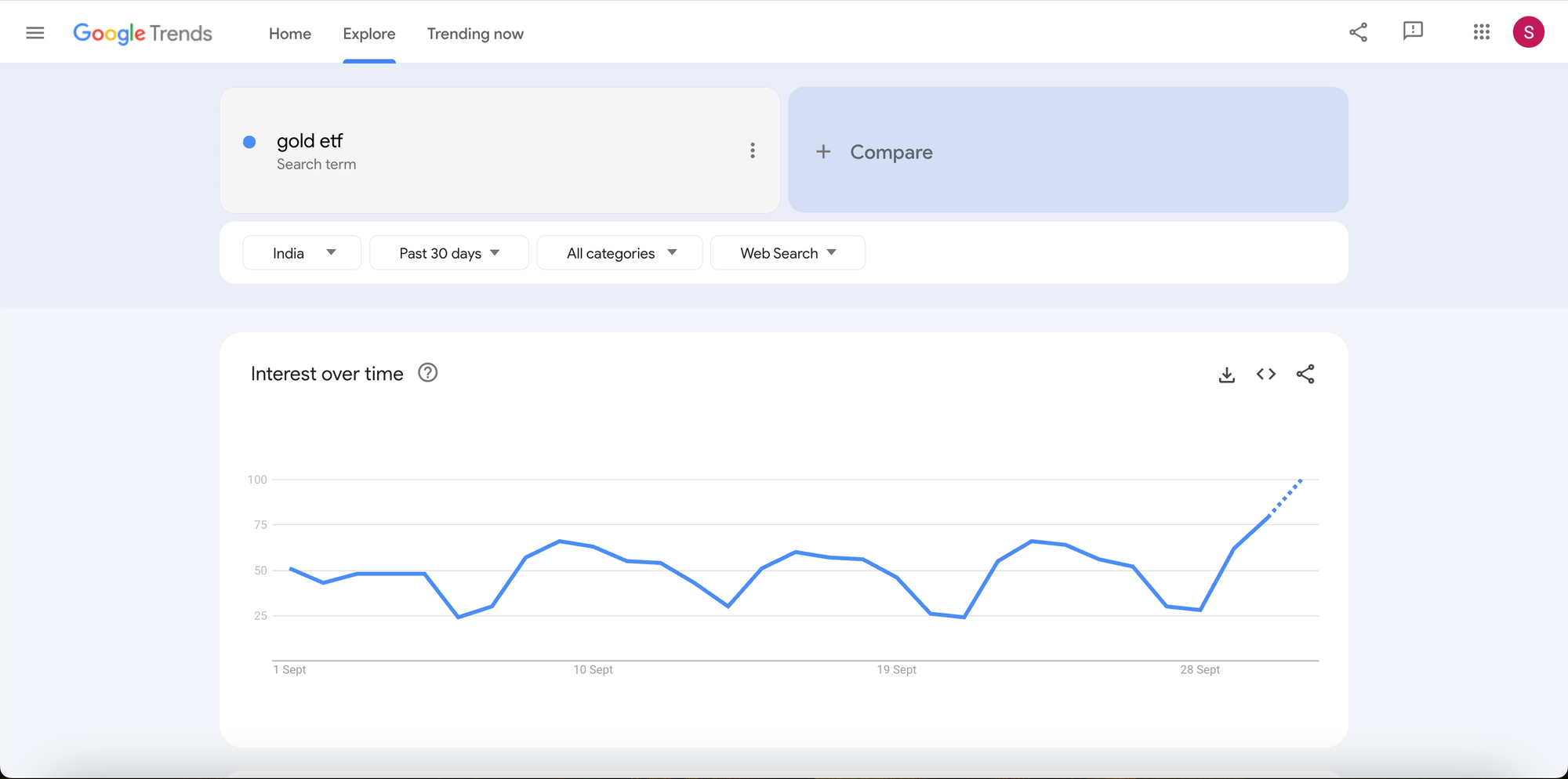

Did you know you can also buy Gold via Gold ETFs and Gold Mutual Funds.

Why is it auspicious to buy Gold during Dhanteras?

The belief in Dhanteras as the most auspicious day to buy gold is rooted deeply in symbolism, tradition, and cultural psychology. For centuries, gold has been associated with Goddess Lakshmi, the deity of wealth, and buying gold on this day is thought to bring prosperity.

This is not merely a spiritual belief, but according to jewellers, the festive demand during Dhanteras contributes a large chunk of their yearly sales.

Tradition also plays a big role, with families handing down the tradition of buying gold during Dhanteras across generations, which ensures a stable seasonal influx of demand.

Falling on the Trayodashi tithi just before Diwali, the occasion symbolizes new beginnings, which also reflects in the financial markets, jewellery businesses, which often lead to stronger Q3 earnings, and a demand-led hike in gold stocks.

The celebratory atmosphere enhances this effect. Gold buying becomes a communal ritual with crowded showrooms, promotional activities, and extensive advertising, thereby creating a herd-driven momentum. This sentimental demand often results in short-term price volatility during the Diwali window.

Gold is not just an ornament in India, but also serves as a store of value and an inflation hedge. This mixed nature positions gold buying during Dhanteras as a practice that is both faith-based and financially driven.

Gold price trends in 2025 and beyond

Gold is on its growth trajectory, which can be attributed to several macroeconomic factors.

The increase in geopolitical uncertainty has continued to push global investors towards gold as a safe-haven investment, and a weaker rupee that has depreciated by almost 4.8% against the US dollar this year has added to domestic gold prices.

On the global front, central banks have collectively added more than 400 tonnes of gold during the first half of 2025, boosting the gold demand.

Festive and wedding season purchases have added to the momentum in India. Analysts expect gold to remain steady during Diwali 2025, with potential for upside if global economic risks persist.

Gold’s journey over the past decade has demonstrated why gold is the most reliable festive and financial asset in India. From ritualistic purchases on Dhanteras to serving as a hedge against uncertainty, gold blends faith with finance.

Wrapping it up

Initially, a tradition of welcoming Goddess Lakshmi has transformed over centuries into a custom with a motive to preserve wealth. This custom has been evident in the past decade, with the trend of the festive demand pushing the gold prices gradually upward due to the effect of the macroeconomic forces such as inflation, the depreciation of the rupee, and the global safe-havens flows.

Today, for common people, buying gold on Dhanteras is not only a pious act but also a way to bind wealth generation with religion.